Blockchains are fast becoming integral to global payments infrastructure, as demonstrated by SWIFT’s recently announced partnership with tech firm Consensys and more than 30 international banks to develop a shared ledger. The blockchain-based ledger will record, sequence, and validate transactions via smart contracts and support the transfer of various forms of regulated tokenized value, such as stablecoins, tokenized deposits, and central bank digital currencies (CBDCs).

How the ledger will work

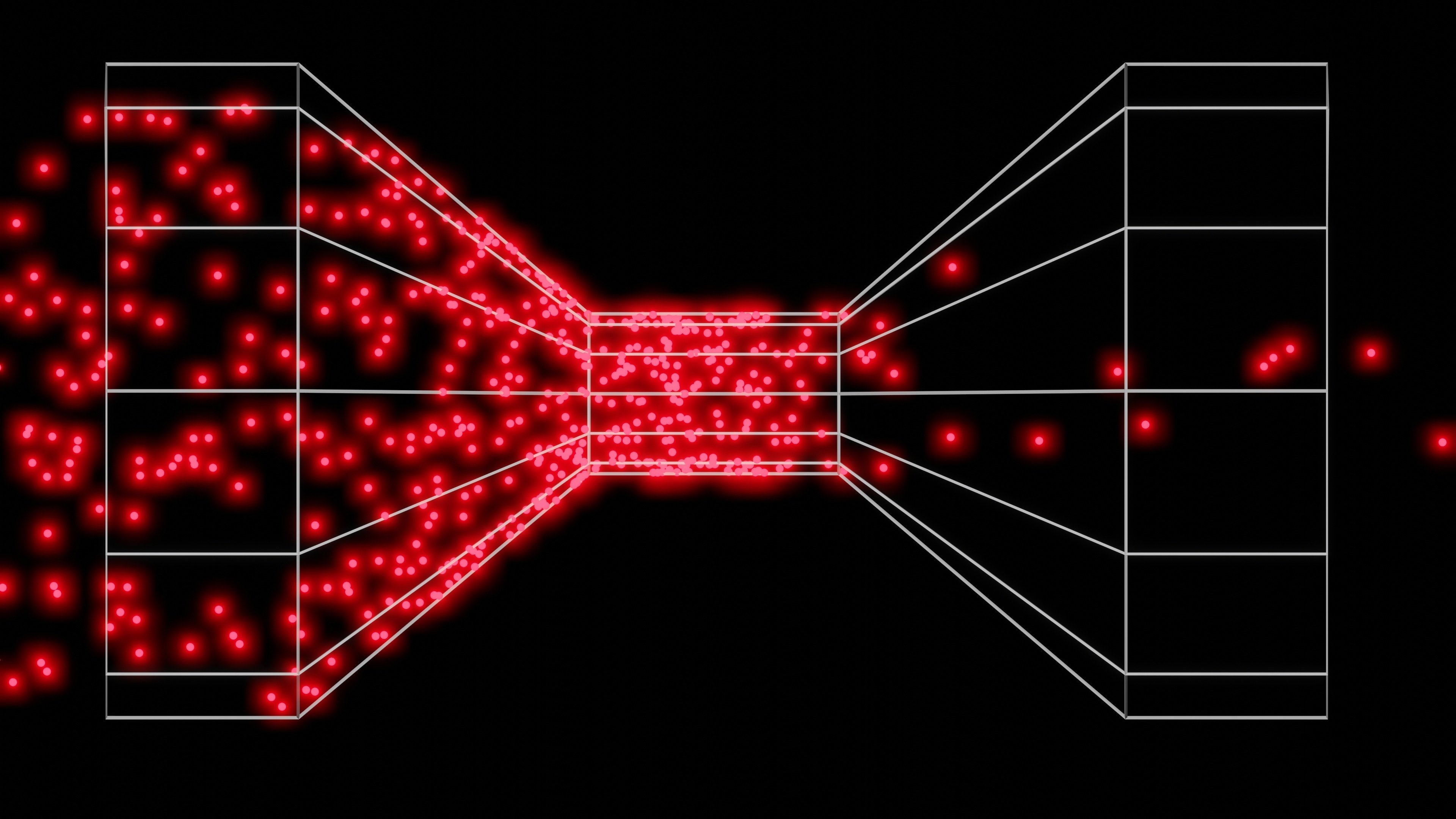

As the corporative underpinning international correspondent banking, SWIFT provides the messaging framework that links over 11,000 financial institutions across more than 200 countries. The proposed ledger will sit atop SWIFT’s existing infrastructure as a secure, always-available record of transactions, enforcing business rules via smart contracts, and interoperate with current payment systems. This will allow enabling banks to perform multi-currency transfers using a single platform, which SWIFT hopes will reduce reconciliation headaches and speed up settlement times. Participating banks include ANZ, Bank of America, BNP Paribas, Citi, Deutsche Bank, JPMorgan, and Standard Chartered.

Keeping up with competitive pressures

The project aims to pave the way for the industry’s next generation of financial market infrastructure. However, the aim isn’t to replace the existing network but rather to add a digital layer to it to support tokenized assets. This will also allow banks to settle transactions outside normal business hours and time zones, greatly easing the challenges inherent to cross-border payments and transactions.

The initiative comes amid rising competition from fintechs like Ripple, which already offers blockchain-based cross-border payment networks by connecting the individual ledgers of multiple banks. SWIFT’s own centralized messaging system has long been a bottleneck for faster international payments, and the emergence of solutions like Ripple’s, not to mention the rise of stablecoins and CBDCs, threatens to bypass SWIFT entirely.

By building their own ledger in collaboration with dozens of established global banks, SWIFT seeks to stay relevant while also capitalizing on their vast reach. Moreover, the project also shows that major banks have a preference for collaborating on blockchain-based solutions, rather than building siloed systems. This will surely further increase industry-wide adoption and bring greater trust to an industry that’s long been sidelined by mainstream finance.

The potential benefits for consumers are also substantial: lower fees, faster international transaction settlements, and the ability to pay in their preferred currency—or token. If successful, there’s every chance the shared ledger could become the backbone of future cross-border payments, complementing rather than replacing existing infrastructure.

.png?width=1816&height=566&name=brandmark-design%20(83).png)