In a move aimed at broadening Stripe’s real-time payments and bank account verification capabilities, specifically for non-card-based bank payments, the global payments services provider has acquired fintech startup Orum for an undisclosed amount.

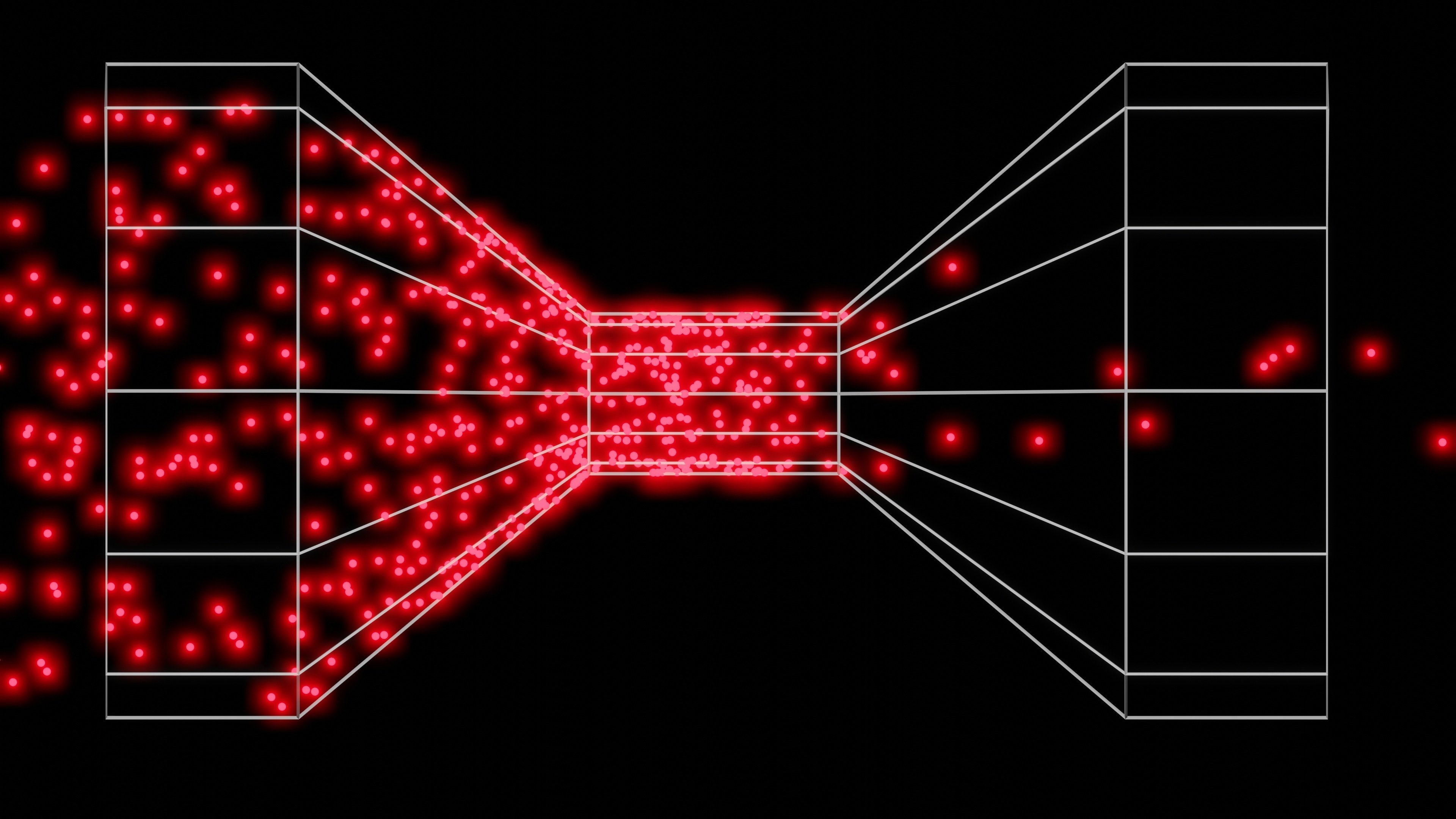

New York-based Orum has carved out a niche in the payments and transactions sector by addressing two of the most persistent bottlenecks in digital finance: First, it provides payment orchestration for bank payments via its real-time payments (RTP) network and support for the FedNow instant payment infrastructure, along with established methods like Same Day ACH, traditional ACH, and wire transfers. Second, Orum specializes in instant verification and payouts, exemplified by its ability to confirm the validity of a US bank account in less than 15 seconds. This represents a huge improvement over other methods, such as making microdeposits. Furthermore, the platform uses AI to augment its abilities to predict the availability of funds and orchestrate immediate payouts.

For Stripe, the move is a strategic effort to expand its dominance beyond core capabilities in card-based payments as demand for real-time, bank-based transfers rises thanks to lower transaction fees. The acquisition follows a common pattern for the world’s largest privately owned fintech giant, which aims to diversify its platform and has manifested in other recent deals like its acquisition of crypto wallet Privy in June.

The growing demand for instant payments, particularly non-card-based payments, also exemplifies a gradual convergence of traditional and digital banking services. While traditional payment services have long been criticized for their slowness, modern digital payment systems are often called out for their high fees.

The potential of a ubiquitous and fully interoperable payment system presents the obvious solution to these issues, and that potential has already been demonstrated globally: India’s Unified Payments Interface (UPI) has already proven a huge success since its launch in 2016, and it now processes 85% of the country’s digital payments. By contrast, FedNow only launched in 2023, with over 900 financial institutions joining the network within the first year. However, although it has already surpassed the Clearing House’s RTP network in that respect, its transaction volume and overall impact on payments are still developing.

Nonetheless, Stripe’s acquisition of Orum will likely serve to validate the growing case for real-time payments in the US, thus helping it transition from an experimental phase into one of widespread deployment.

.png?width=1816&height=566&name=brandmark-design%20(83).png)