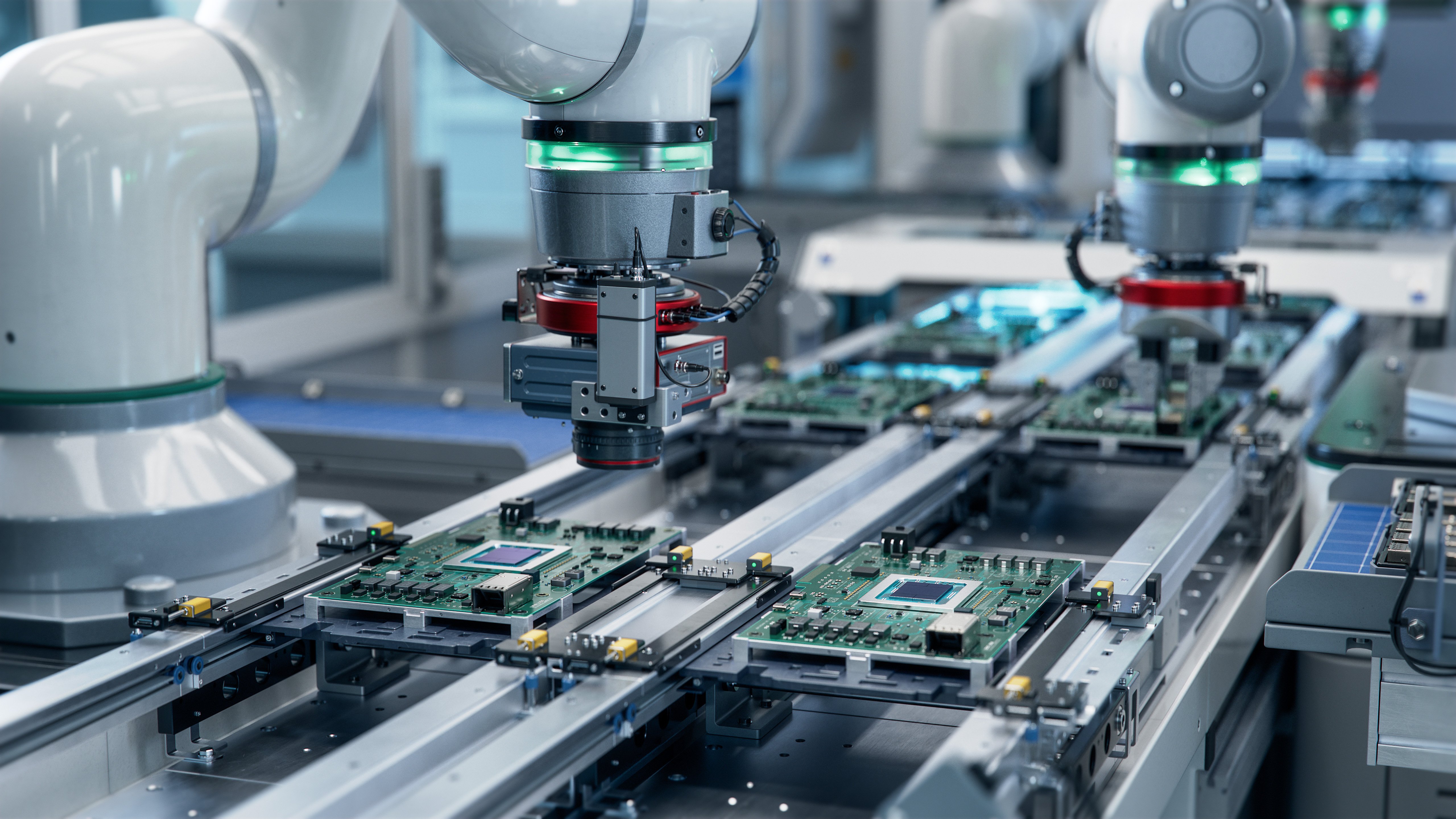

Modernizing banking operations is now imperative. Trusted legacy systems and processes while still valuable will become liabilities if banks don’t bridge the widening gap between what their technology delivers today and the seamless, secure real-time experiences that what business and the market now demand. 👉Read the full report

The bulk of banking executives (86 percent) say modernization is either very important or critical to achieving their long-term strategic goals. They are striving to close gaps by modernizing platforms, enhancing data capabilities, and delivering digital experiences that restore harmony in the money lifecycle, according to the 2025 Global State of Bank Modernization & Technology survey conducted in April 2025 by TechStudioTM, an Energize Marketing® company, in partnership with FIS®. The study found that executives understand the urgency around modernization and are eager to get their efforts underway. Nearly two-thirds (64 percent) expect to begin their modernization journey within the next 12 months, a confirmation of strong momentum gathering across the industry.

But while leaders say modernization is critical to achieving strategic goals and have plans to go forward, just 18% feel equipped to execute those plans. Perhaps that is because outdated infrastructure remains a formidable obstacle. The limitations of legacy systems, the complexities of integration, gaps in performance and scalability, security vulnerabilities and data management issues top the list of challenges cited by executives.

In particular, they grapple with legacy platforms, which often are incompatible with modern features such as mobile-first design or flexible APIs. Just over half are trying to meet that challenge by taking a sidecar approach, running new services alongside legacy systems.

“Systems at times can’t handle increasing transaction volumes or high traffic.” – Chief Product & Technology Officer, Bank, New Zealand

The findings are clear, too, that while more than two-thirds (68 percent) feel that internal skills have been sufficiently honed to embark on their modernization journeys, nearly half would be more confident doing so if they had outside help from a systems integrator or technology consultant. Most have already solicited those relationships—74 percent already have partnered with a system integrator.

📊 By the Numbers: Global State of Business Banking

86% say modernization is critical, but only 18% feel fully ready

74% already have a systems integrator partner in place

64% plan to start modernization within 12 months

Modernization clearly has become a present imperative. Bank executives are under tremendous pressure to close the competitive gap, and they understand that legacy infrastructure, disjointed data systems, and internal readiness gaps are preventing them from delivering the real-time, digital-first experiences their customers expect. If they don’t resolve these issues, they risk falling behind faster-moving peers. To keep pace and thrive, banks are closing operational, architectural, and talent gaps, investing in composable platforms, forming relationships with trusted technology partners and committing to measurable, phased implementation models.

👉 To explore all findings, download the full 2025 Global State of Bank Modernization & Technology report (fielded in April 2025).

.png?width=1816&height=566&name=brandmark-design%20(83).png)